SB 731 Application: A Straightforward Guide

Senate Bill 731 (SB 731) significantly impacts various aspects of [State Name]'s [relevant sector, e.g., healthcare, education, etc.]. Understanding the application process is crucial for those affected. This guide provides a straightforward walkthrough, answering common questions and offering valuable insights. Note: Specific details may vary depending on your individual circumstances and the latest updates to the bill. Always refer to the official [State Agency/Department] website for the most current information.

What is SB 731?

SB 731, officially titled "[Insert Official Title of the Bill]", is a [State Name] law that [clearly and concisely explain the bill's purpose and key provisions]. It aims to [explain the overarching goal of the bill, e.g., improve access to healthcare, reform education funding, etc.]. Key components include [list the main provisions of the bill, e.g., new funding opportunities, eligibility requirements, reporting procedures, etc.].

Who is Eligible to Apply for SB 731 Benefits/Funding?

Eligibility criteria for SB 731 are [clearly explain eligibility requirements. Include specific examples if possible, e.g., income limits, residency requirements, specific professions or industries]. For instance, [provide a concrete example, e.g., "healthcare providers in underserved areas" or "schools meeting certain accreditation standards"]. It's crucial to carefully review the official guidelines to ensure you meet all requirements before starting the application process.

What Documents are Required for the SB 731 Application?

The required documentation for an SB 731 application can vary. Generally, you will need [list required documents, e.g., proof of identity, proof of residency, tax returns, financial statements, business licenses, etc.]. Prepare these documents in advance to streamline the application process. Incomplete applications may result in delays or rejection.

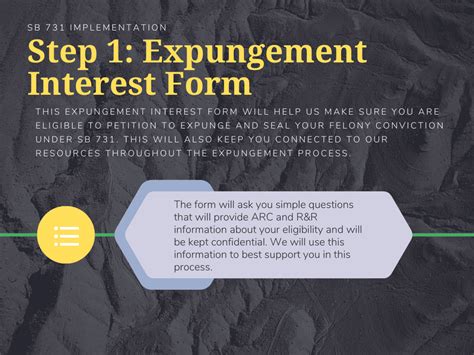

How to Complete the SB 731 Application Form?

The application form itself can be found on the official [State Agency/Department] website. [Explain the steps involved in completing the form: provide clear instructions. For example: "First, create an account. Then, fill in all required fields accurately and completely. Upload all necessary supporting documents. Finally, review your application before submitting."] Remember to double-check all information for accuracy to avoid errors.

What Happens After Submitting the SB 731 Application?

After submission, the [State Agency/Department] will review your application. [Explain the review process: e.g., processing timeframes, notification procedures, appeal processes]. You may be contacted for additional information or clarification. Keep a copy of your submitted application and all supporting documentation for your records.

What are the Common Reasons for SB 731 Application Rejection?

Common reasons for application rejection include [list reasons for rejection: e.g., incomplete applications, inaccurate information, failure to meet eligibility criteria, missing required documents]. Understanding these potential pitfalls can help you prepare a stronger application.

How Can I Track the Status of My SB 731 Application?

You can typically track the status of your application online through the [State Agency/Department]'s website. [Explain the tracking process: e.g., login details, tracking number, status updates]. If you encounter difficulties tracking your application, contact the relevant department directly for assistance.

Where Can I Find More Information About SB 731?

For the most up-to-date information, including detailed guidelines, FAQs, and contact information, always refer to the official website of the [State Agency/Department] responsible for administering SB 731. [Provide the website link if available]. You can also contact them directly via phone or email for further assistance.

Disclaimer: This guide is intended to provide general information and should not be considered legal or professional advice. Always consult with the appropriate authorities or professionals for specific guidance related to your situation and the latest updates to SB 731.